Saturday, May 31, 2014

Be inspired!

Labels:

chaos,

cognitive,

deconstruction,

depression,

evidence based medicine,

investment,

masterpiece of the day,

nice idea,

paradigm,

real science,

video

Friday, May 30, 2014

The Seven Deadly Sins of Biotech Investing

From nere:

http://www.thestreet.com/story/12725934/1/the-seven-deadly-sins-of-biotech-investing.html

4. Company-issued press releases are the best way to stay current and informed on the positive progress being made by the biotech stock you just bought. Don't bother reading SEC filings like 10-Ks, 10-Qs, proxies or registration statements. Like scientific papers, these SEC filings are overly wordy and filled with obtuse numbers and technical jargon. Also, the SEC is well known to be in the back pocket of the hedge funds, which explains why the SEC filings of the biotech stock you just bought are often filled with risk factors and other information used as ammunition by short sellers and bashers.

If you happen to find yourself accidentally reading risk factor statements in SEC filings, remain calm, take a deep breath and remember it's all boiler plate language. Everything you need to know about the biotech stock you just bought can be found in the company-issued press releases -- and those don't contain risk statements!

5. The strength of the intellectual property of the biotech stock you just bought is best determined by counting the number of patents and patent applications. If this number is uncomfortably low, it's okay to give the company extra credit for thinking about filing a patent, or even just mentioning the word "patent" on a conference call or in a press release. If the management of the biotech stock you just bought never mentions the word "patent," assume they're silent on purpose to keep their groundbreaking scientific discoveries out of the hands of competitors, short sellers and bashers. NEVER read an actual patent application. It's a waste of time and will put you to sleep. ALWAYS assume any patent application mentioned by management will be granted. Competitors' patent applications will be rejected. If in doubt, consult your favorite Internet stock message board for guidance.

6. Keep a close eye on the price of the biotech stock you just bought. The intraday price of your stock tells you almost everything you need to know about the health of your investment. When the price of the stock goes up, the "tutes" -- institutional investors --have discovered your amazing biotech stock and are buying behind you to catch up. A rising stock price also means shorts are scared and covering before the inevitable, massive short squeeze runs them over. Either way, it's always a good idea to buy more of the biotech stock you just bought when the price rises.

In the unlikely event that the biotech stock you just bought falls in value, it's a clear indication of an attack by the shorts. If this happens, check in with your favorite Internet message board. There, you will likely find a link to a negative article written by a reporter or blogger who is clearly getting paid to shill for the short-selling hedge funds. These are bad people trying to steal your shares without doing the proper DD you did. The best way to fight a coordinated short attack is to buy more shares of the biotech stock you just bought. Keep buying.

7. Now that you've bought your biotech stock, it's not necessary to sell it ever, even if your original investment thesis plays out. Everybody knows a buy-and-hold strategy is best. Resist the temptation to sell just because new information has come to light, particularly if that news is negative. Only losers and weak hands sell when the thesis they bought into doesn't pan out. Winners simply change their thesis and buy more! Also, selling a biotech stock shows disrespect to all those patients with terminal illnesses who will otherwise be cured.

Thanks again to Brent B. for sharing. He tweets from the handle @bin2gray.

http://www.thestreet.com/story/12725934/1/the-seven-deadly-sins-of-biotech-investing.html

The Seven Deadly Sins of Biotech Investing:

1. Listen intently to all conference calls and analyst meetings because management can be counted on to speak freely and openly about potential pitfalls in the business, ongoing research and clinical trials. Management will also place all drug development programs in the proper industry context, pointing out competitive risks, for example. History teaches that biotech executives rarely spin or otherwise try to promote their stock. On the whole, they are an honest bunch who always place shareholder interests above their own, so it's a waste of time to seek outside, expert perspectives.

2. Find a good Internet message board to discuss how great an investment the biotech stock you just purchased really is. When spending time on this message board, be sure to read closely all posts from those who are the most vocal proponents of the biotech stock you own. These people demonstrate their commitment by never writing anything critical. No one wants to attend a church where the preacher has doubts. The best posters will write at length about how the science behind the biotech stock you own has no rival and will completely change the world we live in. Lucky for you the world does not know this yet; you are one of a select few!

You may safely ignore others who are more critical. It is well known these bashers are paid by hedge funds shorting your biotech stock and are only hanging out on the message board to shake your confidence. Once you sell and the stock drops, these hedge funds will swoop in and buy the stock lower. Don't let them do this! Honestly, if someone is not a true believer why would he be hanging out on a biotech stock message board in the first place? It makes no sense.

3. If/when you do read "outside" material -- best found by looking for links helpfully posted on your favorite Internet biotech stock message board -- be sure to highlight and read again and again those passages confirming your beliefs in the biotech stock you just purchased. If you have time, copy and paste those same passages to your favorite Internet stock message board to show your fellow longs how to conduct proper "DD." By doing this, you will celebrate together the riches to come.

Be careful. Sometimes you will come across information about the biotech stock you just bought which conflicts with your beliefs. When this happens, it's best to either ignore the negative information, or better yet, copy/post to the Internet stock message board with a healthy serving of disgust and ridicule. If you're lucky, the resident expert on the message board will help remind everyone the negative information about the biotech stock you purchased was obviously the work of an uninformed person, a short, a basher or an envious scientific competitors out to spin. It's best to avoid reading actual scientific papers, altogether. They are full of messy details, caveats and are generally too hard to understand. It's much better to learn all you need to know about the science of the biotech stock you just bought from other, more-educated true believers on Internet stock message boards.

1. Listen intently to all conference calls and analyst meetings because management can be counted on to speak freely and openly about potential pitfalls in the business, ongoing research and clinical trials. Management will also place all drug development programs in the proper industry context, pointing out competitive risks, for example. History teaches that biotech executives rarely spin or otherwise try to promote their stock. On the whole, they are an honest bunch who always place shareholder interests above their own, so it's a waste of time to seek outside, expert perspectives.

2. Find a good Internet message board to discuss how great an investment the biotech stock you just purchased really is. When spending time on this message board, be sure to read closely all posts from those who are the most vocal proponents of the biotech stock you own. These people demonstrate their commitment by never writing anything critical. No one wants to attend a church where the preacher has doubts. The best posters will write at length about how the science behind the biotech stock you own has no rival and will completely change the world we live in. Lucky for you the world does not know this yet; you are one of a select few!

You may safely ignore others who are more critical. It is well known these bashers are paid by hedge funds shorting your biotech stock and are only hanging out on the message board to shake your confidence. Once you sell and the stock drops, these hedge funds will swoop in and buy the stock lower. Don't let them do this! Honestly, if someone is not a true believer why would he be hanging out on a biotech stock message board in the first place? It makes no sense.

3. If/when you do read "outside" material -- best found by looking for links helpfully posted on your favorite Internet biotech stock message board -- be sure to highlight and read again and again those passages confirming your beliefs in the biotech stock you just purchased. If you have time, copy and paste those same passages to your favorite Internet stock message board to show your fellow longs how to conduct proper "DD." By doing this, you will celebrate together the riches to come.

Be careful. Sometimes you will come across information about the biotech stock you just bought which conflicts with your beliefs. When this happens, it's best to either ignore the negative information, or better yet, copy/post to the Internet stock message board with a healthy serving of disgust and ridicule. If you're lucky, the resident expert on the message board will help remind everyone the negative information about the biotech stock you purchased was obviously the work of an uninformed person, a short, a basher or an envious scientific competitors out to spin. It's best to avoid reading actual scientific papers, altogether. They are full of messy details, caveats and are generally too hard to understand. It's much better to learn all you need to know about the science of the biotech stock you just bought from other, more-educated true believers on Internet stock message boards.

4. Company-issued press releases are the best way to stay current and informed on the positive progress being made by the biotech stock you just bought. Don't bother reading SEC filings like 10-Ks, 10-Qs, proxies or registration statements. Like scientific papers, these SEC filings are overly wordy and filled with obtuse numbers and technical jargon. Also, the SEC is well known to be in the back pocket of the hedge funds, which explains why the SEC filings of the biotech stock you just bought are often filled with risk factors and other information used as ammunition by short sellers and bashers.

If you happen to find yourself accidentally reading risk factor statements in SEC filings, remain calm, take a deep breath and remember it's all boiler plate language. Everything you need to know about the biotech stock you just bought can be found in the company-issued press releases -- and those don't contain risk statements!

5. The strength of the intellectual property of the biotech stock you just bought is best determined by counting the number of patents and patent applications. If this number is uncomfortably low, it's okay to give the company extra credit for thinking about filing a patent, or even just mentioning the word "patent" on a conference call or in a press release. If the management of the biotech stock you just bought never mentions the word "patent," assume they're silent on purpose to keep their groundbreaking scientific discoveries out of the hands of competitors, short sellers and bashers. NEVER read an actual patent application. It's a waste of time and will put you to sleep. ALWAYS assume any patent application mentioned by management will be granted. Competitors' patent applications will be rejected. If in doubt, consult your favorite Internet stock message board for guidance.

6. Keep a close eye on the price of the biotech stock you just bought. The intraday price of your stock tells you almost everything you need to know about the health of your investment. When the price of the stock goes up, the "tutes" -- institutional investors --have discovered your amazing biotech stock and are buying behind you to catch up. A rising stock price also means shorts are scared and covering before the inevitable, massive short squeeze runs them over. Either way, it's always a good idea to buy more of the biotech stock you just bought when the price rises.

In the unlikely event that the biotech stock you just bought falls in value, it's a clear indication of an attack by the shorts. If this happens, check in with your favorite Internet message board. There, you will likely find a link to a negative article written by a reporter or blogger who is clearly getting paid to shill for the short-selling hedge funds. These are bad people trying to steal your shares without doing the proper DD you did. The best way to fight a coordinated short attack is to buy more shares of the biotech stock you just bought. Keep buying.

7. Now that you've bought your biotech stock, it's not necessary to sell it ever, even if your original investment thesis plays out. Everybody knows a buy-and-hold strategy is best. Resist the temptation to sell just because new information has come to light, particularly if that news is negative. Only losers and weak hands sell when the thesis they bought into doesn't pan out. Winners simply change their thesis and buy more! Also, selling a biotech stock shows disrespect to all those patients with terminal illnesses who will otherwise be cured.

Thanks again to Brent B. for sharing. He tweets from the handle @bin2gray.

Thursday, May 29, 2014

Tolerance edition... Fake?

Labels:

chaos,

cognitive,

deconstruction,

depression,

future foresight,

paradigm,

politics,

real science,

shit of the day

Wednesday, May 28, 2014

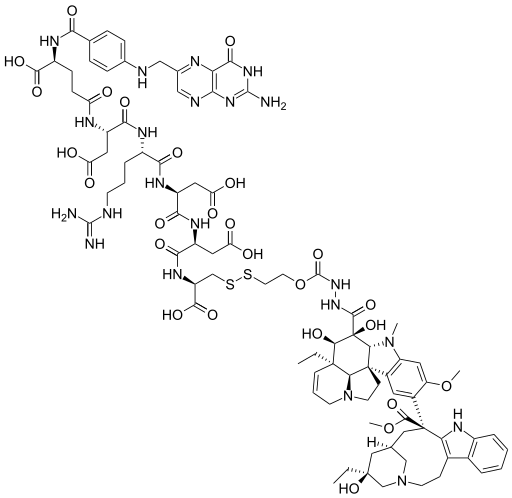

Targeted failure of the week. Post No 151. BBI608

Dainippon said it will continue its other trials of BBI608 in combination regimens, including a Phase III trial to treat gastric cancer and a Phase II trial to treat colorectal cancer. The company gained BBI608 through its 2012 acquisition of Boston Biomedical Inc.

Labels:

bubble,

Death Valley,

deconstruction,

evidence based medicine,

failure,

shit of the day,

targeted failure

Tuesday, May 27, 2014

Half empty...

Labels:

cognitive,

deconstruction,

depression,

failure,

real science,

shit of the day

Sunday, May 25, 2014

Surprised?

Labels:

chaos,

cognitive,

deconstruction,

depression,

Drug Delivery,

future foresight,

politics,

real science,

shit of the day,

targeted failure

Saturday, May 24, 2014

Superbag are superlucky!

Public support for antibiotics research couldn’t come at a more crucial time. The WHO warned last month that bacterial resistance may turn common infections and minor injuries into killers within this century. In the U.S., at least 2 million people become infected with drug-resistant bacteria each year, leading to at least 23,000 deaths, according to the Centers for Disease Control and Prevention.

Public support for antibiotics research couldn’t come at a more crucial time. The WHO warned last month that bacterial resistance may turn common infections and minor injuries into killers within this century. In the U.S., at least 2 million people become infected with drug-resistant bacteria each year, leading to at least 23,000 deaths, according to the Centers for Disease Control and Prevention.

AstraZeneca’s most advanced experimental project is a combination of ceftazidime and avibactam called CAZ-AVI.

Friday, May 23, 2014

Thursday, May 22, 2014

Wednesday, May 21, 2014

Tuesday, May 20, 2014

Targeted failure of the week. Post No 150. Ofatumumab

GSK already markets Arzerra in the U.S. for first-line treatment of chronic lymphocytic leukemia (CLL) and in the U.S. and EU to treat CLL refractory to fludarabine and alemtuzumab. The pharma has worldwide co-development and commercialization rights to the human mAb against CD20 from Genmab, which was off DKK2.60 to DKK208.90 on Monday. The data came after market close in Denmark.

Labels:

Big Pharma,

bubble,

deconstruction,

depression,

failure,

nice idea,

shit of the day,

targeted failure

Zhyvie Belarus!

Labels:

another magic cure,

cognitive,

masterpiece of the day,

politics,

quantum,

real science,

video

Sunday, May 18, 2014

The progress... Post modern.

Labels:

chaos,

cognitive,

deconstruction,

future foresight,

paradigm,

politics,

real science,

shit of the day

Saturday, May 17, 2014

Friday, May 16, 2014

Sad but true

Labels:

chaos,

cognitive,

deconstruction,

depression,

failure,

masterpiece of the day,

nice idea,

real science

Thursday, May 15, 2014

Fake?

Labels:

another magic cure,

cognitive,

deconstruction,

depression,

nice idea,

politics,

real science,

shit of the day

Wednesday, May 14, 2014

Targeted failure of the week. Post No 149. Darapladib

GlaxoSmithKline said its drug darapladib had not reduced heart attacks or other major events in patients with acute coronary syndrome, marking another disappointment for the innovative heart medicine.

GlaxoSmithKline said its drug darapladib had not reduced heart attacks or other major events in patients with acute coronary syndrome, marking another disappointment for the innovative heart medicine.http://www.reuters.com/article/2014/05/13/us-glaxosmithkline-darapladib-idUSKBN0DT0BU20140513

Labels:

Big Pharma,

deconstruction,

depression,

failure,

targeted failure

Tuesday, May 13, 2014

Show me the money: Which drugs made the top 10 list on upfront deals?

Labels:

Big Pharma,

bubble,

deconstruction,

future foresight,

investment,

nice idea,

numbers,

paradigm,

real science

Monday, May 12, 2014

Ukraine will be free!

Labels:

chaos,

deconstruction,

failure,

nice idea,

paradigm,

politics,

real science,

shit of the day,

video

Sunday, May 11, 2014

How to win! Fake?

Labels:

another magic cure,

chaos,

cognitive,

deconstruction,

future foresight,

nice idea,

paradigm,

politics,

real science,

shit of the day

Russians dreams. Fake?

Labels:

chaos,

cognitive,

deconstruction,

future foresight,

paradigm,

politics,

real science

Friday, May 9, 2014

WWF. ABC of.

Labels:

bubble,

cognitive,

deconstruction,

future foresight,

paradigm,

politics,

real science,

shit of the day,

video

Tuesday, May 6, 2014

Jobs. Quote of the day

Labels:

another magic cure,

cognitive,

deconstruction,

evidence based medicine,

magic,

masterpiece of the day,

nice idea,

paradigm,

quantum,

question of the day,

quote of the day,

real science,

video

Monday, May 5, 2014

Sunday, May 4, 2014

Quote of the day

Labels:

cognitive,

deconstruction,

failure,

masterpiece of the day,

politics,

quote of the day,

real science,

semantic

Saturday, May 3, 2014

Targeted failure of the week. Post No 148. Vintafolide

May 2 (Reuters) - Merck & Co Inc and Endocyte Inc said they had stopped a late-stage trial of their experimental ovarian cancer drug because it did not improve survival rates without the cancer worsening.

May 2 (Reuters) - Merck & Co Inc and Endocyte Inc said they had stopped a late-stage trial of their experimental ovarian cancer drug because it did not improve survival rates without the cancer worsening.

The trial was testing the drug, vintafolide, in combination with a chemotherapy drug, pegylated liposomal doxorubicin (PLD), compared to PLD plus a placebo.

An independent safety committee reviewing the trial had recommended that it be halted, the companies said in separate statements.

Labels:

Big Pharma,

chaos,

Death Valley,

deconstruction,

depression,

Drug Delivery,

evidence based medicine,

failure,

shit of the day,

targeted failure

Friday, May 2, 2014

New drugs pricing. The higher the better!

Labels:

Big Pharma,

bubble,

deconstruction,

evidence based medicine,

future foresight,

numbers,

paradigm,

politics,

real science,

shit of the day

Thursday, May 1, 2014

Barracudas? The example?

Labels:

cognitive,

deconstruction,

failure,

nice idea,

paradigm,

real science,

shit of the day,

video

Subscribe to:

Posts (Atom)