I

have

proven that Big Pharma is not interested in innovations and R&D

working process are very inefficient. Here are

the

same suggestions from Wall Street analyst. Very interesting

reading:

Wall

Street analyst Raghuram Selveraju likens today’s drug-development

landscape to the changes seen in men’s professional tennis between

the era of Bjorn Borg and John McEnroe and the completely different

game played today by the likes of Roger Federer and Novak Djokovic.

In today’s tennis, the ball is hit much harder and yet at the same

time there is almost no margin for error. Likewise, he says, in

drug-development today, companies must navigate tougher regulatory

requirements for both efficacy and safety.

“The

margin for error is razor thin and if you miss it, you lose big time.

Aspirin would not get approved at the FDA in today’s atmosphere,”

said Selveraju, managing director and head of health care equity

research at Aegis Capital.

That

desperation leads to the repetition of familiar mistakes which derive

from the predictable thinking of too many business development

executives at big pharma, Selveraju opined. First, when looking for

licensing opportunities, pharmas very often seek out their comfort

zone – a potential product for which they can deploy an existing

sales force or promote to doctors they already know and communicate

with. Also, to be confident in an experimental drug’s preclinical

and clinical data, pharmas often want to go into areas where their

competitors also have a compound as well as into validated targets.

“Basically,

they’re a bunch of lemmings,” Selveraju said. “As soon as a

target becomes hot, they all have to have a molecule in that space,

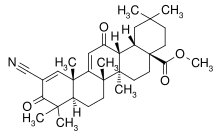

hitting that target. We’ve seen that multiple times: with the DPP4

inhibitors, the statins, the S1P inhibitors now, the nucs in

hepatitis C.” Bristol paid $2.5 billion for Inhibitex and its nuc

in part because months before Gilead had paid $11 billion for

Pharmasset and its promising, mid-stage nuc.

And

it’s just not that easy, at least not today. The low-hanging fruit

largely has been picked – there is no preponderance of easy-to-hit,

druggable targets available to business development groups, Selveraju

explained. Faced instead with a panoply of more difficult to address

therapeutic indications, business development officials often must

make decisions based on incomplete data and at the same time pay out

huge premiums because of the competition with other companies to find

“the next big thing.”

“Big

pharma chases targets and it chases indications,” he said. “That’s

what leads to these deals with outsized valuations and to the

disappointingly high failure rate. If big pharma were to take a more

pragmatic approach, a more rational approach, then we might not be

seeing so many of these failures and we’d certainly be seeing more

judiciously priced deals.”

What

then is Selveraju’s prescription for better business development

practices? It might disappoint those who want pharma to be in the

vanguard of innovation. He recommends incremental innovation –

using FDA’s 505b2 pathway to develop products with already defined

efficacy and safety – as well as biosimilars and re-purposing.

Pharma also should focus on niche and specialty indications, and

largely eliminate primary care products and the large commercial

operations that come with them.

That

may be an unappealing remedy for many, but given the spate of recent

blow-ups in pharma/biotech deal-making, something needs to change.

Right?

Yes,

basically it is right. I think and hope that R&D activity has to be

changed. I strongly believe in a paradigm

shift. And only states and Big Pharma have the necessary

resources for that. Not all Big Pharma corporations will survive the coming

dramatic changes. But the winner takes it all...