Friday, August 31, 2012

... unexpectedly

Labels:

another magic cure,

cognitive,

deconstruction,

nice idea,

real science,

shit of the day,

video

Big Deal!

Genmab has agreed a deal that could be worth over $1.1

billion with a unit of Johnson & Johnson for the rights to a cancer agent,

giving the U.S. company a 10.7 percent equity stake in the Danish biotech

group.

Genmab said on Thursday that J&J unit Janssen

Biotech Inc would obtain global license rights to cancer agent daratumumab.

Genmab said on Thursday that J&J unit Janssen

Biotech Inc would obtain global license rights to cancer agent daratumumab.

Janssen Biotech will make an upfront payment of $55

million for the license and Johnson & Johnson Development Corp would invest

475 million Danish crowns ($80 million) in new Genmab shares, the company said.

I would

just wish J&J good luck with this deal: I hope that they know what they are

doing! Monoclonal

antibodies are still very sexy for Big Pharma, let them burn some more

money!

Labels:

another magic cure,

Big Pharma,

bubble,

investment,

numbers,

paradigm,

Partisan of Death Valley

Thursday, August 30, 2012

Explaining Quantum Computing

Labels:

another magic cure,

bubble,

chaos,

cognitive,

Death Valley,

deconstruction,

dirty swan,

failure,

future foresight,

nanotechnology,

nice idea,

paradigm,

Partisan of Death Valley,

quantum,

video

Bose–Einstein condensate

Labels:

chaos,

cognitive,

deconstruction,

magic,

nanotechnology,

nice idea,

paradigm,

quantum,

real science,

video

Targeted failure of the week. No 15 and 16.

Today we have 2 compounds:

Tivatinib (see the structure) against lung cancer:

Tivantinib, an oral medicine, aims to block an enzyme known as c-Met, which plays a role in the growth and spread of cancer.

Tivantinib, an oral medicine, aims to block an enzyme known as c-Met, which plays a role in the growth and spread of cancer.

Shares of cancer drug developer ArQule (ARQL) are dropping after the company disclosed problems with a clinical trial being conducted in Asia. ArQule’s development partner Kyowa Hakko Kirin of Japan suspended patient enrollment in a late-stage human study of the lung cancer drug tivantinib due to safety concerns.

Pomaglumetad methionil, or mGlu2/3 - the second failed drug, is for treatment of schizophrenia:

Eli Lilly and Co said it would stop developing an experimental schizophrenia drug after a recent analysis showed that a late-stage trial on the drug was likely to fail.

An independent futility analysis concluded that the second late-stage study on the drug was unlikely to meet the main goal of the trial, the company said .

Well, and what compound will fail next?

Labels:

Big Pharma,

bubble,

deconstruction,

evidence based medicine,

failure,

paradigm,

Partisan of Death Valley,

shit of the day,

targeted failure

Wednesday, August 29, 2012

Classical Medicine vs Alternative Medicine. A draw.

”Classical”

science and medicine is in a dead end with the targeted

paradigm and personalized

medicine and is not useful anymore in the development of new medicinal

products. In order to switch the attention from this failure, adepts of the “classical”

approach blame other competitive approaches that they are not scientific,

pseudoscientific etc etc etc. Well, I do agree that the vast majority of these

approaches (90 or 95 or even 99%!) is bogus, no doubts about it! But WHY people

constantly seek alternative approaches for treatment? The answer is soberly

simple: because the “classical” medicine DOES NOT PROVIDE cures which is supposed

to do. A classical doctor cannot just say: “Our modern monoclonal antibody

cannot cure your breast cancer therefore you have to die – AND DO NOT GO TO

OTHER DOCTORS, game is over”. If the doctor cannot help with classical approach

– (s)he cannot exclude the possibility that other “non-classical” modes of

treatment will be helpful! But the desire to exclude competitors is extremely

huge! One of the nice examples is here:

the author tries very desperately to deconstruct alternative medicine. I would just

recommend to the author: forget homeopathy, diet science, urinotherapy etc and

just find something which will cure cancer, - and believe me: everybody will

forget this bogus alternative medicine and will build a monument to you!

”Classical”

science and medicine is in a dead end with the targeted

paradigm and personalized

medicine and is not useful anymore in the development of new medicinal

products. In order to switch the attention from this failure, adepts of the “classical”

approach blame other competitive approaches that they are not scientific,

pseudoscientific etc etc etc. Well, I do agree that the vast majority of these

approaches (90 or 95 or even 99%!) is bogus, no doubts about it! But WHY people

constantly seek alternative approaches for treatment? The answer is soberly

simple: because the “classical” medicine DOES NOT PROVIDE cures which is supposed

to do. A classical doctor cannot just say: “Our modern monoclonal antibody

cannot cure your breast cancer therefore you have to die – AND DO NOT GO TO

OTHER DOCTORS, game is over”. If the doctor cannot help with classical approach

– (s)he cannot exclude the possibility that other “non-classical” modes of

treatment will be helpful! But the desire to exclude competitors is extremely

huge! One of the nice examples is here:

the author tries very desperately to deconstruct alternative medicine. I would just

recommend to the author: forget homeopathy, diet science, urinotherapy etc and

just find something which will cure cancer, - and believe me: everybody will

forget this bogus alternative medicine and will build a monument to you!

Labels:

bubble,

chaos,

deconstruction,

evidence based medicine,

failure,

future foresight,

paradigm,

Partisan of Death Valley,

real science,

shit of the day

Tuesday, August 28, 2012

Paradigms of Physics. Pereslegin & Co.

Labels:

another magic cure,

chaos,

cognitive,

Death Valley,

deconstruction,

future foresight,

magic,

nice idea,

paradigm,

Partisan of Death Valley,

politics,

quantum,

real science,

video

Multiple Sclerosis: is simplicity best or who win the race?

Very

interesting article is here.

Just to

summarize the situation with MS treatment: we have very nice treatment Copaxone

which will

become generic in a couple of years. Then we have an experimental oral drug BG-12:

The company's experimental drug BG-12 (dimethyl

fumarate) is in late stage clinical trials. BG-12 is designed to treat

relapsing-remitting MS. When given twice daily, BG-12 cut the relapse rate by

44 percent at two years compared with a placebo. When given three times a day,

it cut the relapse rate by 51 percent. If approved BG-12 could become the

world's leading treatment for MS.

44 and 51%

are much-much better than Copaxone

(which) reduced the rate by 29 percent versus a placebo.

And now we

have yet another experimental drug: Laquinimod.

At this moment I will not say much about the clinical trials, I will just see on

the structures of the drugs! Something unusual? Yes, both compounds look

extremely simple (heterocycle molecule on the picture is Laquinimod), especially BG-12! And I would like to ask anybody who works

in this field: how in the world these simple compounds can treat MS??? One of

the answers is here:

And now we

have yet another experimental drug: Laquinimod.

At this moment I will not say much about the clinical trials, I will just see on

the structures of the drugs! Something unusual? Yes, both compounds look

extremely simple (heterocycle molecule on the picture is Laquinimod), especially BG-12! And I would like to ask anybody who works

in this field: how in the world these simple compounds can treat MS??? One of

the answers is here:

The mechanism of action is not fully understood, but

preclinical studies have suggested that BG-12 may have complex neuroprotective

and anti-inflammatory effects, acting via the Nrf-2 pathway. Activation of the

Nrf-2 pathway defends against oxidative-stress induced neuronal death, protects

the blood-brain barrier and supports maintenance of myelin integrity in the

central nervous system.

But this

answer is basically making the picture even more complicated…

I cannot

connect the dots… And in my experience it usually does mean just one thing:

BLUFF! And the first I could imagine that clinical trials with BG-12 were

accomplished in a “creative” way. Let’s wait what FDA and EMA will say – we

have 4 years to wait:

An extension study for participants on the DEFINE and

CONFIRM studies to assess the long-term effectiveness and safety of BG-12 for a

further two years. Estimated completion date June 2016.

I would

like to wish a success for all the companies who are developing novel drugs

against MS. I hope that BG-12, Laquinimod and other novel drugs will be helpful

against MS – no doubts about it! What drug will be more useful? Only time will

show…

Monday, August 27, 2012

Molecular gastronomy. Again

Just alginate, agar and... Bon Appetit!

Labels:

another magic cure,

cognitive,

deconstruction,

nice idea,

real science,

video

International Space Station

Pemetrexed – just wait 5 years...

Eli Lilly & Co. (LLY) won a U.S. appeals court ruling that upholds the validity of a patent for the lung- cancer drug Alimta and blocks generic competition through 2017.

The U.S. Court of Appeals for the Federal Circuit today rejected arguments by Teva Pharmaceutical Industries Ltd. (TEVA) that the patent was invalid. It affirmed a lower court ruling. The decision was posted on the court’s website.

The U.S. Court of Appeals for the Federal Circuit today rejected arguments by Teva Pharmaceutical Industries Ltd. (TEVA) that the patent was invalid. It affirmed a lower court ruling. The decision was posted on the court’s website.

Alimta, whose chemical name is pemetrexed, generated $2.5 billion in sales last year for Indianapolis-based Lilly, making it the company’s third biggest-selling drug. Alimta is designed to hamper cancer cells’ ability to use folic acid to grow after an initial treatment with other drugs.

Teva, based in Petah Tikva, Israel, had argued that Lilly had patented a compound that wasn’t much different from what was covered by two earlier patents. The three-judge panel said the lower court was correct to rule that the 2017 patent is distinct from the earlier inventions.

Well, just 5 years... And then – generic!

Labels:

deconstruction,

future foresight,

nice idea,

numbers,

paradigm

Sunday, August 26, 2012

Music of the week. Just amazing...

Saturday, August 25, 2012

Masterpiece of the day. Nobody repeates it!

Nano-Art or Nano-hallucinations?

Targeted failure of the week. No 13-14.

This time we have solanezumab (monoclonal failure against AD):

After years of anticipation and growing skepticism, Eli Lilly this morning disclosed that an Alzheimer’s medication failed to meet the primary endpoints, both cognitive and functional, in a pair of Phase III double-blind, placebo-controlled trials in patients with mild-to-moderate Alzheimer’s disease. Although disappointing, the outcome was actually mixed, but may still renew questions about the future for Lilly as it grapples with its commitment to Alzheimer’s research.

After years of anticipation and growing skepticism, Eli Lilly this morning disclosed that an Alzheimer’s medication failed to meet the primary endpoints, both cognitive and functional, in a pair of Phase III double-blind, placebo-controlled trials in patients with mild-to-moderate Alzheimer’s disease. Although disappointing, the outcome was actually mixed, but may still renew questions about the future for Lilly as it grapples with its commitment to Alzheimer’s research.

And BMS-986094 (which targets polymerase, an enzyme essential for the replication of the hepatitis C virus):

(Reuters) - Bristol-Myers Squibb Co (BMY) said it would record a $1.8 billion charge related to the discontinuation of its much-anticipated hepatitis C drug that was dropped after a patient died of heart failure.

The company will recognize the charge in the third quarter of 2012, it said in a regulatory filing on Friday. It does not expect the charge to result in future cash expenses.

The pharmaceutical company said on Thursday it would drop development of the drug, called BMS-986094, after a patient who was treated with the drug in a mid-stage trial died of heart failure and several others had to be hospitalized.

Bristol had voluntarily stopped the mid-stage trial earlier this month.

The drug, which was acquired by Bristol through its $2.5 billion purchase of Inhibitex Inc, belongs to a promising new class of hepatitis C drugs known as nucleotide polymerase inhibitors.

What targeted drug will fail next?

Labels:

Big Pharma,

bubble,

chaos,

deconstruction,

failure,

paradigm,

targeted failure

Friday, August 24, 2012

Magentic nanoparticles in drug delivery as a "rocket science"

The article-review is here. It is very interesting - no doubt about it. The approach probably will be used somewhere in the future (2100? - not earlier, it is for sure). The picture for illustration of the scale differences is one of the best I've seen:

Labels:

another magic cure,

deconstruction,

Drug Delivery,

nanotechnology,

nice idea,

paradigm,

real science

Debt Bomb, Debt Bomb...

Labels:

bubble,

deconstruction,

failure,

macro economy,

nice idea,

paradigm,

real science,

shit of the day

Global Markets for Asthma: Fresh Numbers

The report is here (just for $4850!!!):

The global market for asthma and chronic obstructive pulmonary disease (COPD) prescription drugs was valued at $34.9 billion in 2011. This figure is projected to reach $38 billion in 2012 and $47.1 billion in 2017, increasing at a five-year compound annual growth rate (CAGR) of 4.4%.

The global market for asthma and chronic obstructive pulmonary disease (COPD) prescription drugs was valued at $34.9 billion in 2011. This figure is projected to reach $38 billion in 2012 and $47.1 billion in 2017, increasing at a five-year compound annual growth rate (CAGR) of 4.4%.Combination asthma/COPD drugs are expected to be worth $17.4 billion in 2012 and should reach $21.3 billion in 2017, a CAGR of 4.1%.

The segment made up of asthma drugs is projected to increase from $15.3 billion in 2012 to $20.2 billion in 2017, a CAGR of 5.7%.

COPD drugs are expected to increase from $5.3 billion in 2012 to $5.6 billion in 2017, a CAGR of 1.2%.

The global market for asthma and chronic obstructive pulmonary disease (COPD) prescription drugs was valued at $34.9 billion in 2011. This figure is projected to reach $38 billion in 2012 and $47.1 billion in 2017, increasing at a five-year compound annual growth rate (CAGR) of 4.4%.

The global market for asthma and chronic obstructive pulmonary disease (COPD) prescription drugs was valued at $34.9 billion in 2011. This figure is projected to reach $38 billion in 2012 and $47.1 billion in 2017, increasing at a five-year compound annual growth rate (CAGR) of 4.4%.Masterpiece of the day. Just India

Thursday, August 23, 2012

Alzheimer’s R&D: targeted failure

A

very interesting article regarding failures with novel drugs against AD.

We know

that monoclonal antibodies are sh…t and will not be useful:

The biggest hope for the treatment of Alzheimer’s

disease in a long time just went up in smoke. The next high-profile drug

candidate will probably be toast in a few weeks, analysts say.

The easiest

thing now would be to write off the whole field of Alzheimer’s R&D, and declare

that scientists have to go back to the drawing board.

This is the major category of drug getting most of the

negative attention because of the failure of the Pfizer/J&J/Elan drug and

expected failure of Lilly’s drug, also an antibody. These drugs are designed to

specifically bind to and clear plaques that are piling up in Alzheimer’s

patients, causing neurotoxicity that leads to all the tragic symptoms of the

disease.

Scientists have long been attracted to anti-amyloid

beta antibodies for Alzheimer’s, because they can be designed to specifically

bind with the amyloid beta peptides while mostly sparing healthy tissues. While

the failure of bapineuzumab (or “bapi” for short) is a downer for the field,

some people, Ives included, say Pfizer/J&J/Elan may have a better chance

using the drug in an Alzheimer’s population that hasn’t yet displayed many

symptoms.

Essentially, the argument is that the companies were

trying to help patients after it was already too late. “Think about a car

wreck,” Ives says. “Bapi is like a tow truck clearing away the wreckage, but

there’s already been a wreck. You really want to prevent the accident.”

And to go

back to the drawing board will be the best idea. But what will be proposed

instead of mAbs? Almost the same “targeted” approaches!

Gamma Secretase inhibitors and modulators:

One other major class in development are drugs that

regulate the gamma secretase, Ives says. These drugs are synthetic chemical

compounds that can be made into oral pills, which can conveniently be taken by

patients on a daily basis at home. They are designed to bind with an enzyme,

gamma secretase, which chops up larger amyloid into smaller amyloid beta

peptide pieces. In patients with Alzheimer’s, gamma secretase enzymes

overproduce longer amyloid beta peptides that pile up to form plaques that are

toxic to nerves.

Drugs from the past that sought to inhibit gamma

secretase, like Lilly’s semagacestat, looked to have potential for a while, but

failed in the third and most expensive phase of clinical trials.

Early-generation gamma secretase inhibitors also shut down all kinds of other

essential protein processing in cells, which led to toxicity that prompted drug

developers to limit their dosing and stop trials, Ives says.

And another

one:

BACE Inhibitors:

Another class

of drugs in development can be filed under the header of beta secretase, or

BACE, inhibitors. These drugs are also small molecule compounds made to bind

with a different kind of enzyme in cells, one that performs its amyloid

processing work at an earlier step in the amyloid pathway than gamma secretase,

Ives says. Drugmakers have labored for years against these targets, because

inhibiting beta secretase can clearly reduce production of amyloid beta

peptides in their various lengths, which should reduce the troublesome plaque

deposits.

Companies like

Lilly, Merck, and Roche all have drug candidates moving through

early-to-mid-stage clinical trials, and they generated a fair bit of buzz at

the Alzheimer’s Association meeting in Vancouver, BC in July, Ives says. As

Alzheimer Research Forum science writer Esther Landhuis described it recently,

drugs in this class have long struggled to get into the brain, to stay there,

or to fend off other molecules that would render them inactive. “At long last,

drug developers have overcome these and other hurdles, and well over a decade

of effort developing beta-secretase (BACE1) inhibitors is starting to pay off,”

Landhuis wrote.

One big

question with BACE inhibitors, Ives says, is what happens over time to people

who have so much of their amyloid processing shut down. If people take these

drugs for three decades to prevent Alzheimer’s, what kind of unforeseen side

effects might pop up? “That chapter remains to be written,” Ives says.

I would

conclude: It is better not to get AD due to it seems like new efficient treatment

will not be developed in the nearest decades…

Labels:

Big Pharma,

bubble,

chaos,

cognitive,

Death Valley,

deconstruction,

depression,

failure,

future foresight,

paradigm,

Partisan of Death Valley,

politics,

shit of the day,

targeted failure

Targeted failure of the week. No 12.

It is not

for sure (!), BUT it is very close to be true that in the nearest future we will

get another candidate: Bavituximab (sure - the monoclonal antibody!)

Peregrine (the company owned the medicine – my comment) has been working on Bavi (the short name of the

drug – my comment) for nine

years and still has not even reached Phase III. It has been working on Cotara (another

drug of the company – my comment) for an even longer period of time, and Cotara has now been put on the

back burner after Peregrine stoked shareholders' hopes for years with press

releases about Cotara's Phase II trials. Normally drugs that are actually

game-changing treatments reveal their amazing capabilities in a shorter period

of time, particularly for diseases that have median survival periods of only a

few months. If either Cotara or Bavi were revolutionary treatments, it seems

unlikely that they would have needed nearly a decade to prove themselves. And

if Bavi were really an amazing treatment for a variety of cancers, we would

think that another pharma company would have recognized that by now and already

partnered with Peregrine.

Peregrine (the company owned the medicine – my comment) has been working on Bavi (the short name of the

drug – my comment) for nine

years and still has not even reached Phase III. It has been working on Cotara (another

drug of the company – my comment) for an even longer period of time, and Cotara has now been put on the

back burner after Peregrine stoked shareholders' hopes for years with press

releases about Cotara's Phase II trials. Normally drugs that are actually

game-changing treatments reveal their amazing capabilities in a shorter period

of time, particularly for diseases that have median survival periods of only a

few months. If either Cotara or Bavi were revolutionary treatments, it seems

unlikely that they would have needed nearly a decade to prove themselves. And

if Bavi were really an amazing treatment for a variety of cancers, we would

think that another pharma company would have recognized that by now and already

partnered with Peregrine.

What “targeted”

candidate will be next?

Do not use Avastin!

From here

New guidance for doctors issued by the National Institute for Health and

Clinical Excellence (Nice) does not recommend Avastin (bevacizumab) to treat

women with the disease, it said.

Labels:

Big Pharma,

bubble,

deconstruction,

evidence based medicine,

failure,

real science,

targeted failure

Wednesday, August 22, 2012

Cell therapy – let’s blow a new bubble!

As we have already proven

the main target of Big Pharma is to profit from different bubbles but not to develop

a useful medicinal products. The creature and design of such bubbles is very

important issue and it usually takes a decade to complete it. We can name a

couple of last successful examples here: personalized medicine and “targeted”

medicines. The targeted approach is almost expired (we are somewhere close to "return to "normal"" point, see the picture) and is not “sexy” anymore

however personalized medicine is still alive (but

not very long, we are exactly on the top - "new paradigm!" point) and successfully consumes tremendous amounts of resources. What

will come next? As far as I understand it will be cell therapy (I have written

already a little bit about this issue here).

The approach of using cell therapy complies with all criteria to be attractive

for Big Pharma:

1. Cell therapy is absolutely

ineffective – no new dangerous disease will be cured. The market will be not

affected

2. The manufacturing and development

are very expensive – it will be very simple to motivate high prices for R&D

and final products

I think we are very close to "take-off" point (see the picture). And in press and mass media we have

a lot of bogus-articles which just blowing the bubble. One very nice example is

here:

The regenerative medicine space is a somewhat young

industry that presents the possibility of finding a cure for diseases that were

previously untreated, or simply managed. The healthcare system consists of an

aging population, and with a growing healthcare burden, it seems reasonable

that the approval of cell therapies could be a part of our immediate future.

Already we are seeing a change in government outlook, as many governments and

economies invest millions into the research of cell therapy and regenerative

medicine.

For the first time, regenerative medicine is more than

skin cream; instead, it has become medical therapies that treat or cure

cardiovascular and degenerative diseases (which one and where the results? – Pharmalitet comment). With the number of companies

beginning clinical studies for cell therapies, investors should feel optimistic…

- Nice language to use “should” instead of “are”!

The cell therapy industry is a more risky investment,

yet presents the potential for a large return. At this point, the data proves

efficiency for many of the top candidates, therefore, leaving the question

regarding approvals and regulator acceptance as the only relevant discussion. – Exactly! And so far – so bad?

The Tissue Engineering and Regenerative Medicine

International Society (TERMIS) is the world's largest professional organization

for tissue engineers; and it just recently announced the results from a survey

of 37 organizations for public and private sectors. The results showed that

government remains highly invested in regenerative medicine, with more than 55%

investing over $5 million in the space. In addition to strong government

support, both the public and private sectors showed an increase in interest and

investments in the space. – Absolutely, this is very direct sign that the bubble is being blown!

And the

conclusion is amazing:

As we progress into the next few years, several

companies will inch closer to regulatory decisions, and the space itself will

be determined by the outcome of candidates such as Baxter's CD34+ cell therapy

and the regulatory acceptance of Osiris' Prochymal. It will be an interesting

space to watch, but with key developments and progress that continue to shine,

it does appear the future is bright for innovating cell therapies.

And

everybody seems to be happy! But Big Pharma will be happy in the first place! J

Labels:

another magic cure,

Big Pharma,

bubble,

chaos,

Death Valley,

deconstruction,

dirty swan,

failure,

future foresight,

investment,

macro economy,

paradigm,

Partisan of Death Valley,

real science

Masterpiece of the day. Matematics as cryptomatics

Labels:

chaos,

cognitive,

deconstruction,

masterpiece of the day,

nice idea,

paradigm,

real science,

shit of the day

U.S. Pharmaceutical Sales - Q2 2012

Fresh numbers are here

Tuesday, August 21, 2012

Music of the week. No tomorrow

Labels:

depression,

future foresight,

magic,

music of the week,

video

A perfect future?..

Labels:

cognitive,

deconstruction,

failure,

future foresight,

nice idea,

real science,

video

FDA approval: how to use it?

Do you

think you can make money on stock market? Why not? Everybody can do it, there

are a lot of strategies including the simplest one: when stock price goes up -

you go long, when it goes down - you go short. You have nice triggers: 31

Drugs Facing FDA Approval in 2012-2013. Good luck!

Do you

think you can make money on stock market? Why not? Everybody can do it, there

are a lot of strategies including the simplest one: when stock price goes up -

you go long, when it goes down - you go short. You have nice triggers: 31

Drugs Facing FDA Approval in 2012-2013. Good luck!

Labels:

Big Pharma,

bubble,

deconstruction,

future foresight,

investment,

nice idea,

Partisan of Death Valley,

real science

Monday, August 20, 2012

A.I.Fursov. Germany vs UK. Part 2

Labels:

cognitive,

deconstruction,

future foresight,

macro economy,

nice idea,

paradigm,

quantum,

real science,

video

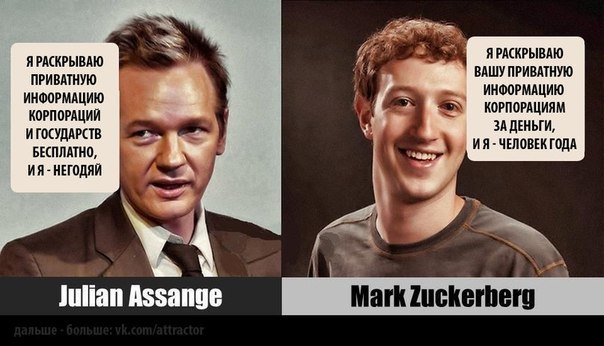

Masterpiece of the day. Wikileaks

Labels:

chaos,

cognitive,

deconstruction,

masterpiece of the day,

nice idea,

paradigm,

politics,

real science,

shit of the day

ABC of history of cybernatics

Part 1

Part 2

Part 3

Part 4

Part 5

Part 6

Labels:

cognitive,

Death Valley,

deconstruction,

future foresight,

magic,

nice idea,

paradigm,

Partisan of Death Valley,

politics,

quantum,

real science,

video

Sunday, August 19, 2012

Masterpiece of the day. $ becomes a paper... The very first step

Labels:

bubble,

chaos,

deconstruction,

depression,

macro economy,

magic,

masterpiece of the day,

nice idea,

paradigm,

politics,

quantum,

real science,

shit of the day

Big Pharma and patent cliff: how to make a “win-win” situation

The patent cliff (for some fresh numbers see also here) is one of the dangers that threaten Big Pharma, however Big Pharma is very creatively prepared to handle this problem.

When a patent expires, the original holder and the first generic manufacturer to file with the US government both get an exclusive six-month right to sell an unbranded alternative. So branded drug makers figured they could settle patent suits simply by giving up that right - with no actual payment changing hands. A generic challenger would receive a lucrative six-month monopoly when the patent expired, while the original holder would avoid what it considered an early end to patent protection.

Pfizer essentially took that approach in settling with Teva Pharmaceutical Industries over the rights to the antidepressant Effexor XR. According to a lawsuit brought by drug retailers, Teva delayed its generic version for two years in exchange for Pfizer's promise not to compete once Teva did start production. The drug's annual US sales topped $2.5 billion over those years, the suit claims.

Pfizer essentially took that approach in settling with Teva Pharmaceutical Industries over the rights to the antidepressant Effexor XR. According to a lawsuit brought by drug retailers, Teva delayed its generic version for two years in exchange for Pfizer's promise not to compete once Teva did start production. The drug's annual US sales topped $2.5 billion over those years, the suit claims.

The companies deny wrongdoing and say the deal was just a licensing agreement. But the Federal Trade Commission argued this week that Pfizer made an unlawful payment.

Patent protection allows big drug companies to recoup the enormous costs of bringing compounds to market. But they shouldn't be allowed to chisel the public for more years than they deserve of outsized profits. The judge hearing the case can protect consumers' wallets by saying so.

Well, very smart, no comments. Big Pharma is out there to make profits, preferably in a monopoly way, not to provide inexpensive and efficient medicinal treatment.

Labels:

Big Pharma,

bubble,

cognitive,

deconstruction,

depression,

nice idea,

numbers,

paradigm,

politics,

real science,

shit of the day

Financial crisis in a nutshell

So funny, so simple...

Labels:

bubble,

chaos,

cognitive,

deconstruction,

failure,

future foresight,

macro economy,

magic,

nice idea,

paradigm,

politics,

video

Saturday, August 18, 2012

A.I.Fursov. 1812. Amasing

Labels:

chaos,

cognitive,

deconstruction,

magic,

politics,

real science,

video

Quote of the day. Tarkovsky about happyness

Labels:

chaos,

cognitive,

Death Valley,

deconstruction,

magic,

paradigm,

Partisan of Death Valley,

politics,

quote of the day,

real science,

semantic

Friday, August 17, 2012

Music of the week. M. Farmer

Who would doubt that she becomes undressed in the end of the movie? Typical french :)

HTS as a religion.

We know

that the

modern paradigm of drug development i.e. targeted approach based on key-lock

analogy (see also here)

is

not ontologically consistent. One

of the latest articles in BMJ is also worried about the situation – a lot

of resources are spent with an extremely little outcome. I think that even the majority of

practitioners of the modern paradigm understand that the current approach is

very narrow-minded, simplified and the real picture is

far more complicated.

Basically I

think that the situation is typical for the time close to paradigm shift. And

it is not surprisingly that still there are practitioners fanatically devoted

to the old (inefficient and mechanistic) paradigm. There are no any arguments

which could “open their eyes” – it should be understood. They will defend the

old dogma till the dearth – no matter what…

One of such

I think par excellence practitioner

of the modern paradigm has

described the modern approach in a very informal way. It is impossible to

take a quote from the article – the whole article is worth a thorough reading,

not less the comments of other practitioners to this post. And I follow the

blogs of a couple of such scientists with a great pleasure.

Labels:

Big Pharma,

bubble,

chaos,

deconstruction,

depression,

failure,

paradigm,

Partisan of Death Valley,

real science

Thursday, August 16, 2012

Quote of the day. Step and way.

Labels:

cognitive,

deconstruction,

nice idea,

quantum,

quote of the day,

semantic

Oxaliplatin - now generic!

Non-targeted but very efficient (as other platinum-drugs carboplatin and cisplatin) is available as generic medicin.

The drug is a generic version of Sanofi's Eloxatin, which had sales of $1.7 billion during the 12-month period ended in June

The drug is a generic version of Sanofi's Eloxatin, which had sales of $1.7 billion during the 12-month period ended in June

The structure is simple, the mechanism of action is known - we just wish the successful application!

The drug is a generic version of Sanofi's Eloxatin, which had sales of $1.7 billion during the 12-month period ended in June

The drug is a generic version of Sanofi's Eloxatin, which had sales of $1.7 billion during the 12-month period ended in JuneThe structure is simple, the mechanism of action is known - we just wish the successful application!

Wednesday, August 15, 2012

Tuesday, August 14, 2012

Communist propaganda about Big Pharma and innovation crisis?

The article in BMJ is highly

recommended to read. A lot of facts in a form of cold numbers and a very sober

conclusion:

Data indicate that the widely touted

“innovation crisis” in pharmaceuticals is a myth. The real innovation crisis stems

from current incentives that reward companies for developing large numbers of

new drugs with few clinical advantages over existing ones.

Some

quotes:

The preponderance of drugs without

significant therapeutic gains dates all the way back to the “golden age” of innovation.

Out of 218 drugs approved by the FDA from 1978 to 1989, only 34 (15.6%) were

judged as important therapeutic gains. Covering a roughly similar time period

(1974-94), the industry’s Barral report on all internationally marketed new

drugs concluded that only 11% were therapeutically and pharmacologically

innovative.13 Since the mid-1990s, independent reviews have also concluded that

about 85-90% of all new drugs provide few or no clinical advantages for patients.

The preponderance of drugs without

significant therapeutic gains dates all the way back to the “golden age” of innovation.

Out of 218 drugs approved by the FDA from 1978 to 1989, only 34 (15.6%) were

judged as important therapeutic gains. Covering a roughly similar time period

(1974-94), the industry’s Barral report on all internationally marketed new

drugs concluded that only 11% were therapeutically and pharmacologically

innovative.13 Since the mid-1990s, independent reviews have also concluded that

about 85-90% of all new drugs provide few or no clinical advantages for patients.

How have we reached a situation where so

much appears to be spent on research and development, yet only about 1 in 10

newly approved medicines substantially benefits patients? The low bars of being

better than placebo, using surrogate endpoints instead of hard clinical

outcomes, or being non-inferior to a comparator, allow approval of medicines

that may even be less effective or less safe than existing ones.

[M]arketing has become “the enemy of [real]

innovation.” This perspective explains why companies think it is worthwhile

paying not only for testing new drugs but also for thousands of trials of

existing drugs in order to gain approval for new indications and expand the

market. This corporate strategy works because marketing departments and large

networks of sponsored clinical leaders succeed in persuading doctors to

prescribe the new products. An analysis of Canada’s pharmaceutical expenditures

found that 80% of the increase in its drug budget is spent on new medicines

that offer few new benefits.

And the

following quote is my favorite one!

This hidden business model for pharmaceutical research, sales, and

profits has long depended less on the breakthrough research that executives

emphasise than on rational actors exploiting ever broader and longer patents

and other government protections against normal free market competition.

Companies are delighted when research breakthroughs occur, but they do not

depend on them, declarations to the contrary notwithstanding. The 1.3% of

revenues devoted to discovering new molecules compares with the 25% that an

independent analysis estimates is spent on promotion, and gives a ratio of basic

research to marketing of 1:19.

There are a

lot of other very interesting and reasonable ideas and facts in this article. I

have written about the very bad situation with the innovations and how Big

Pharma is not interested to promote them, Ok, but here we have a second opinion

in face of two (I am sure) very clever and honest professors. I suspect that

they have to be communists…

Labels:

Big Pharma,

bubble,

chaos,

cognitive,

Death Valley,

deconstruction,

depression,

failure,

investment,

macro economy,

nice idea,

numbers,

paradigm,

Partisan of Death Valley,

politics,

real science,

shit of the day

Subscribe to:

Comments (Atom)